Agricultural and Biological Research

RNI # 24/103/2012-R1

Research Article - (2025) Volume 41, Issue 4

The main objective of this study is to examine the analysis of rice prices and market integration in Nigeria. The study used Trend analysis to highlight the trend in the price of rice and also show the pattern in which rice price flows in Nigeria. This study employed a monthly panel data for of a period of 7 years gotten from the National Bureau of Statistics (NBS). The theoretical framework adopted was the price theory. In order to achieve the objectives of the study, correlation analysis was used to explain the degree of market integration between different spatial rice markets, regression analysis was used to explain the structural factors which ted to inhibit or enhance the integration of rice markets in Nigeria and co-integration technique used to identify the factors that affects the changes of rice prices in spatial rice markets. The price of rice fluctuated in its sharp rise and fall in the half period of study implying a high level of instability in the general price level of rice in Nigeria. The price of rice has its highest point in October 2022 and its lowest point in January 2016. Based on the findings from the data analyzed, inflation, price substitute and imported price of rice are found to be a significant policy that has influence the price of rice in Nigeria. Whereas, CPI-Food, exchange rate, rainfall (MM), are also some significant determinant of rice price in Nigeria. Thus, a reduction in inflation and price of imported rice should be adopted by the government so as to improve rice prices and market integration and also to improve the standard of living of people.

Analysis; Exchange rate; Inflation; Rice; Trend; Annual; Importation; Living standard

Rice is one of the major consumable staple produces in Nigeria. Rice is the most widely cultivated cereal and is also among the world’s most important staple food crop with more than half of the world’s population [1]. Rice production in Nigeria started in 1500BC with low yielding indigenous red grain species O. glaberrima Steud then widely grown in Niger delta area. It ranks third after wheat and maize in terms of worldwide production. As a result of expansion of the cultivated land area to rice, there has been a steady increase to rice production and consumption in Nigeria [2]. The production increase however has not been able to meet the consumption demand of the rapidly growing urban population, who has a great preference for parboiled rice. In Sub-Saharan Africa (SSA), where the issue of hunger and poverty has been a global concern, rice has been essential to food security [3]. This situation however led to the acute demand for parboiled rice in the 1990’s which contrasted with Nigeria’s selfsufficiency in rice during the 1960’s. Revenue in rice segment amounts for US$3.85bn in 2023. The market size is expected to grow annually by 10%. In global comparison, most revenue is generated in China. As a response to the prevailing rice supply deficit situation in Nigeria, successive Nigerian governments intervened in the rice sector by increasing tariffs so that local production could be encouraged, [4].

Rice imports have affected the domestic production and marketing of Nigeria’s local rice due to decrease in demand of local rice compared to imported parboiled rice. The local Nigerian variety has a lower demand due to high cost of producing the crop and cost of production is usually not subsidized by the government. The non-competitiveness could also be as a result of poor processing resulting in a final product with high percentage of broken grains and debris [5]. A rice price (local) varies from location to location as well as the imported varieties of rice. Processing of locally made Nigerian rice is one of the reasons why the price of locally made is different from imported variety of rice. Nigeria is currently the highest rice producer in West Africa, producing an average of 3.2 million tons of paddy rice or 2.0 million tons of milled rice [6].

It is the largest consuming nation in the region, with growing demand amounting to 4.1 million tons of rice in 2002, with only about half of that demand met by domestic production. Nigeria imported 1.9 million tons of rice in 2002 valued at approximately 500 million dollars [7]. Rice (Oryza spp.) is the most widely cultivated cereal and is also among the world’s most important staple food crop with more than half of the world’s population. The neglect of the agricultural sector also affected rice production as Nigeria became a major rice importer right after the glorious era of being a major rice producer in Africa [8]. But the launch of the Agricultural Transformation Agenda (ATA) in 2010 marked a reawakening in the agricultural sector. The ATA was part of the Federal Government of Nigeria’s (FGN) effort to revamp the sector in order to enhance food security, job creation and diversification of the economy [9-11]. The transformation agenda as enshrined in ATA was set to create over 3.5 million jobs from rice, cassava, sorghum and cotton value chains, with more jobs to come from other value chains when fully implemented.

Generally, ATA, among others, has the goal of re-defining agriculture as a business by promoting the involvement of private sectors, encouraging the expansion of private sector driven marketing organizations, and promoting incentive-based risk sharing for agricultural credits [12,13]. This suggests that rice production or processing is a sustainable livelihood activity which has the potential to increase and sustain livelihood status. Furthermore, “rice is a priority crop in the implementation for the New Partnership for Africa’s Development-NEPAD and Comprehensive Africa Agriculture Development Programme-CAADP [14]. According to Yogisha and Bruntrupand, integrated markets are ones in which prices are decided in concert [15,16].

Rice is one of the crops being considered under the FGN’s ATA given its growing importance and prominent role among staple food crops in Nigeria. The country has a history of indigenous rice production and high demand [17]. Thus, it is not surprising that rice has emerged as a major staple food crop in Nigeria, given its demand in all the six geopolitical zones, 36 states, all the local governments, and across all socio-demographic groups [18]. All these serve to emphasize the role of rice in poverty alleviation through sustainable livelihood.

More than half of the world's population consumes rice as a nutritious staple diet, making it a significant food crop globally [19]. For roughly half of the human race, it is the most essential staple meal [20].

In 2015, the Federal government through the CBN placed a ban on importation of 41 items including rice from accessing foreign exchange in the official window. It also banned rice imports across land borders and kept 70% tariffs on imports coming through ports. In August 2019, President Muhammadu Buhari ordered the closure of border and ports in which imported goods comes into the country. This is to help the local production of Nigerian made rice, create job and employment opportunities and reduce the nations dependent on rice importation thereby boosting the production level of rice in the economy at large.

A number of factors, including rapid urbanization, population growth, rising per capita income, and changes in family occupation, are influencing the demand for rice in Nigeria. Because of the lifestyle changes it brings about, urbanization is a significant impact in the demand for rice because rice fits the need for food that is convenient and quick to prepare. Even though most consumers mix both imported and local rice in their diets, urban households typically prefer imported rice due to its higher quality, which is defined as having a higher swelling capacity, better taste, preferred grain shape, and cleanliness since imported rice is often polished, undamaged, and free of stones and other debris. For cooking foreign dishes, which are frequently enjoyed by urban homes, imported rice works best?

The main objectives of this study are to characterize the behavior of price trend in Nigeria’s rice markets, to determine the degree of market integration between different spatial markets, to identify the structural factors which tend to inhibit or enhance the integration of rice markets in Nigeria, and to identify the factors that affects the changes of price of rice in spatial rice markets. Therefore, the following section shows the methodology and discussion, followed by the conclusion.

Study area

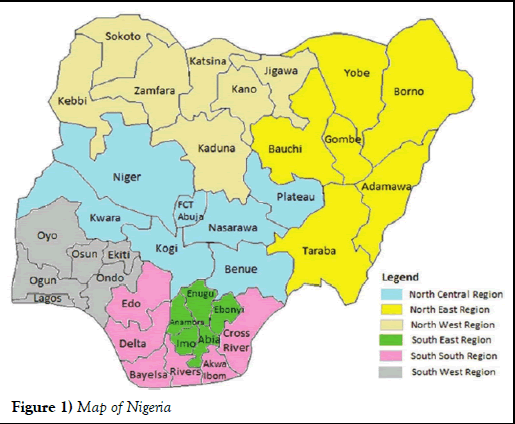

Rice is cultivated in virtually all the agro-ecological zones in the country while the commodity is consumed in both rural and urban areas. The study area is Nigeria and it is called federal republic of Nigeria officially. It has 36 states and its federal capital territory, Abuja. Nigeria is located in West Africa and shares her land border with the republic of Benin in the West, Chad and Cameroon in the East, and Niger in the North. There are over 500 ethnic group in Nigeria of which the largest three Igbo, Hausa and Yoruba. Nigeria is located in Western Africa on the Gulf of Guinea and has a total area of 923,768 km square, making it the world’s 32nd largest country after Tanzania. It is comparable in size to Venezuela and is about twice the size of California. Nigeria lies between latitude 40° to 140°N and longitude 20° and 150°E. The main rivers in Nigeria are the Niger River and Benue River which meet and empty into Niger Delta. Nigeria has a varied landscape, the far south is defined by its tropical rainforest climate where annual rainfall is 60 to 80 inches (1.525 to 2,032 mm) a year. In the southeast stand the Obudu plateau coastal plains which are found in both the southwest and the Southeast. This forest zone’s most southerly portion is defined as salt water swamp which is also known as mangrove swamp because of the large amount of mangroves in the area. Nigeria’s most expensive topographical region is that of the Niger and Benue river valley which merge into each other and form a “Y” shape. Agriculture was the most important sector of the economy before Nigeria gained independence and accounted for more than 50% of GDP and more than 75% of exports earnings. Consequently, with the rapid expansion of the petroleum industry, agricultural development was neglected and the sector entered a relative decline. Nigeria moved from a position of self-sufficiency in basic foodstuff to dependence on imports between the mid-1960 and the mid-1980. Rice is grown in the central and western part of Nigeria and is traded largely outside the cash economy. Nigeria has about 71.2 million hectares of available agricultural land and about half which is currently being utilized. Increasing rainfall from the semi-arid north to the tropical rain forested south allows great crop diversity. The Figure 1 below shows the map of Nigeria and different states including the study area.

Figure 1) Map of Nigeria

Source of data

This paper used secondary data of wholesale and retail prices of rice. This study employed a monthly panel data for a period of 7 years, obtained from various sources spanning from 2016-2022. The data was sourced from an online database maintained by World National Bureau of Statistics (NBS).

Analytical techniques

This study was achieved by analyzing the relationship between markets in Nigeria. Analysis of relationships between prices is a common tool in market integration analysis. The market integration model (showing the basic relationship to be investigated) is expressed as follows; Price transmission of rice markets in the study area was analyzed using the correlation coefficient, specified as: The size of this coefficient and its significance shows the level of inter market dependence. Correlation coefficient (r) greater than 0.8 signifies strong correlation, when r falls between 0.6-0.8, it is regarded as moderate correlation while correlation coefficient (r) less than 0.6 is regarded as weak correlation.

Co-integration technique

Co-integration is a statistical technique that is used to test for a long-run relationship between two or more time series. The first step is to test for stationarity, which is a term for whether a time series is stable over time. After that a test like the Engle-Granger test or the Johansen test can be used to see if the time series are co-integrated. The Engle-Granger test is used to determine if a relationship between two time series is stable over time. It’s often used in econometric analysis and it can be a helpful way to see if the data are co-integrated. The Johansen test is a more advanced co-integration test than can be used to test for more than two time series at once; it can also test for multiple co-integrating relationships.

The co-integrating equation is: ΔYt=α+βXt+εt This equation has four parts;

Δ=Change

Yt=Dependent variable

Xt=Independent variable

α=Constant

εt=Error term

The ADF (Augmented Dickey-Fuller) test is used to test for the presence of a unit root in the residuals from the co-integrating equation. If there is a unit root that means the series is non-stationary, so it does not have a constant mean or variation over time. A unit root will also mean that the variables are not co-integrated.

The Granger causality test is used to determine if one variable Grangercauses another variable. In other words it tests maybe one variable can be used to predict another variable. The Johansen test is similar to the Granger causality test.

Correlation analysis

This is a technique that is used to measure the strength of the relationship between two variables. The correlation coefficient ranges from -1 to 1, and it can tell you whether the variables are positively or negatively correlated. A correlation coefficient of 1 means that the variables are perfectly positively correlated and a correlation coefficient of -1 means that they are perfectly negatively correlated. A correlation coefficient of 0 means that there is no relationship between the variables. Correlation does not imply causation. The correlation coefficient is calculated using a formula called the Pearson product-moment correlation coefficient. It’s given by the following equation:

r =((covariance of X and Y)/(standard deviation of X)) × (standard deviation of Y)

Trend analysis

Trend analysis is a technique used to analyze data over time to identify patterns, trends and correlations. It involves using moving averages, regression analysis and time series analysis to identify trends. Trend analysis can involve using smoothing techniques like exponential smoothing or moving averages to reduce the influence of random fluctuations in the data. Some formulas commonly used in trend analysis include;

These formulas are used to calculate a moving average for a given period of time which can help identify trends in the data.

Regression analysis

Regression analysis is used to estimate the relationships between variables and to predict the value of a dependent variable based on one or more independent variables. The most common type of regression analysis is linear regression which uses the formula Y=α+bX to predict Y based on X. The formula for the regression coefficient (b) is b=((Cov (X,Y))/(Var (X))). The regression coefficient tells you how much Y changes for a given change in X.

The broad objective of this study is to know the analysis of rice prices and market integration in Nigeria. In this section, the data collected from the National Bureau of statistics was presented to show the relationship and significance of the study which strengthens its objectivity.

Trends in retail prices of local rice

The study on rice prices could lead to a better understanding of the factors that affects rice prices. This could have implications for farmers, consumers and policy makers. For farmers, a better understanding of the factors that affects rice prices could help them make decisions about when to plant, harvest and sell their rice. For consumers, a better understanding of rice prices could help them make informed decisions about when to buy rice and how much to buy. For policy makers, a better understanding of rice prices could help them develop policies that support farmers and consumers.

In addition, trend equations from the actual data are estimated in order to give a clearer picture of the movement of prices, graphs are employed in displaying the result.

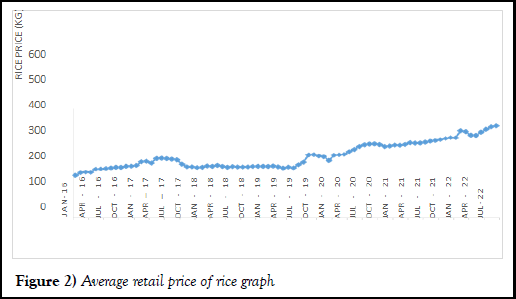

From the graph below, it shows that the trend in rice price showed a fluctuating movement, that is rice prices is not stable as the year increases. From the graph, from January 2016 to July 2017 it shows a gradual increase in rice prices from slightly above 200 to above 300 rice price (kg). From July 2017 to October 2017, the rice price went down a little and maintained an almost constant price from October 2017 to July 2019. From July 2019 to October 2022 it maintained an increase until it got to 500 (price per kg of rice).

The study on the trend of rice prices can help to predict future prices and make informed decisions about production and consumption. By understanding the factors that influence prices, policy makers can make decisions that will stabilize the market and ensure a consistent supply of rice. Additionally, understanding the trends in rice prices can help farmers make decisions about when to plant and harvest their crops. This information can also be used by consumers to make informed decisions about when to buy rice. Figure 2 shows the average retail price of rice as shown below.

Figure 2) Average retail price of rice graph

Correlation matrix of selected rice market in Nigeria

The result presented on Table 1 revealed rice price in different markets in Nigeria. Nine different rice markets were considered in this study and the markets include; Ogun, Taraba, Kaduna, Benue, Niger, Kano, Enugu, Rivers, and Lagos. From the result, it is evidence that rice price in all the markets were positive and strongly correlate with each other. This implied that price of rice in all this market depends on each other.

This study of market integration could lead to a better understanding of how markets are connected and how decisions made in one market can affect other markets. For example, if a study shows that rice prices in one country are influenced by decisions made in another country’s market, this could have implications for trade policy and international relations. This study could also provide insights into how to improve market efficiency and reduce volatility. Understanding how markets are integrated can also help businesses make more informed decisions about where to invest and how to manage risks. This study confirmed where reported correlation between rice market variables in Nigeria and the markets selected were integrated. Also, this study confirmed “Assessing the trend and correlation of rice markets in Malaysia, Thailand and Vietnam” by Sattayasamitsathit Z, et al. They found that there is a strong positive correlation between rice markets in Malaysia, Thailand and Vietnam. This means that the prices of rice in these countries tend to move in the same direction and at similar rates. Another study “Dynamics of rice markets in Ghana: Integration and causality” by Mensah B et al., found that rice markets in Ghana are well integrated and that there is a strong causality between the prices of imported rice and domestic rice in Ghana. It also found that government policies play a role in affecting the prices of rice in Ghana. Table 1 shows the correlation matrix of the selected rice markets in Nigeria.

| Markets | Ogun | Taraba | Kaduna | Benue | Niger | Kano | Enugu | Rivers | Lagos |

| Ogun | 1 | ||||||||

| Taraba | 0.8154* | 1 | |||||||

| Kaduna | 0.8447* | 0.9249* | 1 | ||||||

| Benue | 0.8148* | 0.9503* | 0.8935* | 1 | |||||

| Niger | 0.7396* | 0.8240* | 0.8042* | 0.8070* | 1 | ||||

| Kano | 0.7835* | 0.9379* | 0.9038* | 0.9001* | 0.8161* | 1 | |||

| Enugu | 0.7728* | 0.8858* | 0.8856* | 0.8800* | 0.7194* | 0.8248* | 1 | ||

| Rivers | 0.8714* | 0.9537* | 0.9361* | 0.9328* | 0.8066* | 0.8980* | 0.9025* | 1 | |

| Lagos | 0.8544* | 0.9332* | 0.9084* | 0.9281* | 0.7955* | 0.8943* | 0.8912* | 0.9232* | 1 |

TABLE 1 Correlation matrix of selected rice market in Nigeria

Random-coefficients regression

Random coefficient regression was used to estimate co-integration between price of rice and some other influencing covariates in this study. On Table 2, explanatory variables include: Consumer price index on food, inflation, exchange rate, price of substitute, rainfall amount and the price of the imported rice. From the result, the coefficient of the covariates was all positive except price of the substitutes. Coefficient of inflation, price of substitute and price of imported rice was statistically significant. Furthermore, inflation was positive and significant at 1% level; this indicated that increases in inflation will increase price of rice in Nigeria. So, also, price of imported rice will only increase price of rice in Nigeria. The coefficient of this variable was positive and significant at 5% level of confidence. According to the result presented, the price of substitute was negative and significant at 5% level’ the result indicated that price of substitute food materials will force down the price of rice in Nigeria as the price of these substitute increases. This result established long run cointegration between rice price and other covariates in Nigeria. Table 2 reveals the random coefficient regression analysis result.

| Rice-price | Coefficient | Z | P>|z| |

| CPI-Food | 1.008 | 0.74 | 0.458 |

| Inflation | 0.156*** | 3.37 | 0.001 |

| Exchange rate | 6.89 | 0.77 | 0.438 |

| Price Substitute | -0.046** | -2.32 | 0.024 |

| Rainfall (MM) | 0.013 | 0.2 | 0.842 |

| Imported-price | 1.092** | 2.09 | 0.036 |

| _cons | 140.592 | 11.86 | 0 |

| Note: ** significant at 5%, *** significant at 1% | |||

TABLE 2 Random-coefficients regression

Granger causality test

The result presented on Table 3 below showed granger causality test of the price of rice in different market across regions in the country. The study considers rice production states and non-producing states markets. The information is follows the Granger non-causality test results. From the result, it is evident that the price of rice in Enugu does not granger-cause the price of rice in Ogun state, so also the reverse. The result shows no direction of causality. In the case of Rivers state and Ogun state, the result shows a uni-directional causality of rice price in these two markets. From the result, the price of rice in River state granger-cause the price in Ogun State while the price in Ogun failed to granger-cause rice price in Rivers State. In the case of Taraba and Kano states, it shows that Taraba does not granger-cause the price of rice in Kano state and vice-versa. The result shows a Bi-directional causality of rice price in the two markets. From the results, in the case of Rivers and Taraba, it shows a Uni-directional causality of rice price in these two markets. It shows that the price of rice in Rivers state granger-cause rice price in Taraba state while the price of rice in Taraba state failed to granger-cause rice price in Rivers state. It is evident, that rice price in Lagos state does not granger-cause rice price in Kaduna state, so also reverse the case. The result shows no direction of causality. In the case of Kano and Niger states, it shows that the price of rice in Kano state grangercause price of rice in Niger state and also the price of rice in Niger state granger-cause price of rice in Kano state. This shows a Bi-directional causality of rice prices in the two markets. From the result, the price of rice in in Lagos granger-cause the price of rice in Benue state while the price of rice in Benue state does not granger-cause the price of rice in Lagos state. This shows a Uni-directional causality of rice prices in the two markets. Lastly, from the result, Rivers state does not granger-cause Benue state, also Benue state does not granger-cause Rivers state. It is evident that the price of rice in the two markets shows no causality.

| Statement | W-bar | Z-bar | Z-bar tilde | Remark | Direction of causality |

| Enugu does not Granger-cause Ogun |

1.9383 | 2.2984 (0.0215) |

0.8402 (0.4008) |

Not significant |

No causality |

| Ogun does not Granger- cause Enugu |

0.7434 | -0.6285 (0.5297) |

-0.8192 (0.4127) |

Not significant |

|

| Rivers does not Granger-cause Ogun |

5.7564 | 11.6507 (0.0000) |

6.1424 (0.0000) |

Significant | Uni-directional |

| Ogun does not Granger- cause Rivers |

1.2063 | 0.5053 (0.6133) |

-0.1764 (0.8600) |

Not significant |

|

| Taraba does not Granger-cause Kano |

3.6244 | 6.4284 (0.0000) |

3.1816 (0.0015) |

Significant | Bi-directional |

| Kano does not Granger- cause Taraba | 2.0884 | 2.6660 (0.0077) |

1.0486 (0.2944) |

Significant | |

| Rivers does not Granger-cause Taraba |

3.9036 | 7.1123 (0.0000) |

3.5694 (0.0004) |

Significant | Uni-directional |

| Taraba does not Granger-cause Rivers |

2.2309 | 3.0151 (0.0026) |

1.2465 (0.2126) |

Not significant |

|

| Lagos does not Granger- cause Kaduna |

2.2756 | 3.1247 (0.0018) |

1.3086 (0.1907) |

Not significant |

No causality |

| Kaduna does not Granger-cause Lagos | 1.4093 | 1.0027 (0.3160) |

0.1056 (0.9159) |

Not significant | |

| Kano does not Granger- cause Niger |

6.0309 | 12.3230 (0.0000) |

6.5236 (0.0000) |

Significant | Bi-directional |

| Niger does not Granger- cause Kano |

3.9165 | 7.1440 (0.0000) |

3.5874 (0.0003) |

Significant | |

| Lagos does not Granger- cause Benue |

3.0953 | 5.1324 (0.0000) |

2.4469 (0.0144) |

Significant | Uni-directional |

| Benue does not Granger-cause Lagos |

0.5030 | -1.2175 (0.2234) |

1.1532 (0.2488) |

Not significant |

|

| Rivers does not Granger-cause Benue |

2.2315 | 3.0165 (0.0026) |

1.2473 (0.2123) |

Not significant |

No causality |

| Benue does not Granger-cause Rivers | 0.8647 | -0.3315 (0.7403) |

-0.6508 (0.5152) |

Not significant |

TABLE 3 Granger causality test for some selected markets

P-value in parenthesis

When one market can forecast price changes in another market, it is said that the two markets have a statistically significant relationship and are granger-caused by one another. The price changes in one market cannot be utilized to forecast price changes in the other market if there is no grangercausality between the two marketplaces. In summary, some markets are related, whilst others are not. A study by Faridi N, et al., entitled "Granger causality tests for Bangladesh rice markets and the integration on rice price behavior" is the precursor to this one. This study examined the Granger causality between various marketplaces using data from Bangladesh and discovered that some markets were more integrated than others.

Some inferences might be drawn from the data analysis results in line with the findings. Tariff and exchange rate are discovered to be a significant policy that has influenced the price of rice in Nigeria out of the research of rice prices and market integration taken into consideration by the study. In contrast, the impact of inflation, rice supply, demand, and import are some of the key factors affecting rice prices in Nigeria. The study supports the claim that a number of variables and factors influenced rice prices in Nigeria as well as the degree of spatial market integration. To strengthen the stability of rice prices and market integration, a number of obstacles that affect the pricing of rice in Nigeria's rice markets and the integration of rice markets need to be gradually decreased and curtailed.

This research study analysis suggests that the Nigerian economy be aware of the factors that have a significant impact on economic growth. This research study also makes suggestions for prospective reforms that may be made to the agriculture industry to help it once again realize its full potential and become more effective and productive. The Nigerian government could boost and support domestic production by giving farmers access to facilities and funding for further expansion. This would enable farmers to produce more, which would cut costs and lower the price of rice produced locally. Credit and financial services for farmers would aid in boosting output and reducing costs. Enhanced transportation systems would aid in reducing post-harvest losses and hence lower the price of rice. It would be possible to increase food security and reduce poverty by reducing price differences between areas through well-integrated marketplaces. As a result, market integration barriers should be drastically lowered and limited. The creation of marketing channels should be funded, and farmers should receive training on pricing and marketing tactics. The price of rice may be raised to stimulate greater production, which would lead to more employment being created and less poverty. Data about the state of the market and prices should be accurate and readily available, as this can improve market efficiency by lowering uncertainty. To fulfill the growing demand for rice, the government should implement measures that boost the supply of rice. These suggestions will significantly increase the nation's ability to produce rice and will have a significant impact on people's quality of life. They will also be beneficial to the government in a variety of ways, which will aid it in carrying out its agenda and influencing rice prices and market integration.

Received: 08-Jan-2024, Manuscript No. AGBIR-24-124709; , Pre QC No. AGBIR-24-124709 (PQ); Editor assigned: 10-Jan-2024, Pre QC No. AGBIR-24-124709 (PQ); Reviewed: 24-Jan-2024, QC No. AGBIR-24-124709; Revised: 07-Jul-2025, Manuscript No. AGBIR-24-124709 (R); Published: 14-Jul-2025, DOI: 10.37532/0970-1907.25.41(4):1-6